By Dave Workman

Editor-in-Chief

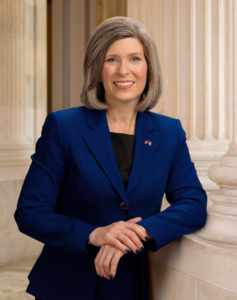

Republican Sen. Joni Ernst of Iowa has proposed legislation to literally disarm agents with the Internal Revenue Service, an effort which quickly drew support from the Citizens Committee for the Right to Keep and Bear Arms, a grassroots gun rights organization.

Ernst appears to be following in the footsteps of her senior colleague, veteran U.S. Sen. Chuck Grassley, by looking for waste and corruption in government. She dubbed her measure the “Why Does the IRS Have Guns Act.”?

“That’s really a very good question,” said CCRKBA Chairman Alan Gottlieb in a prepared statement. “Why has the IRS spent millions of dollars on weapons and ammunition since the start of the coronavirus pandemic three years ago? According to a published report, the agency spent $2.3 million on ammunition, another $1.2 million on ballistic shields, $243,000 on body armor, nearly $475,000 on Smith & Wesson rifles and $463,000 on Beretta tactical shotguns.”

Nobody inside the Beltway has so far bothered to provide an answer to Gottlieb’s question. Yet millions of dollars have been spent on arms and ammunition since at least 2006, according to one published report.

According to a May 1 report at Open the Books, in addition to the guns, ammunition, body armor and ballistic shields, the IRS also bought 3,000 units of “optics compatible tactical holsters for weapons with optical sights and weapons lighting systems.”

Open the Books said the IRS is not alone.

“Since 2006,” the report revealed, “103 rank-and-file agencies outside of the Department of Defense (DOD) spent $3.7 billion on guns, ammunition, and military-style equipment (inflation adjusted to CPI). 27 of those agencies are traditional law enforcement under the Department of Justice (DOJ) and the Department of Homeland Security (DHS).

“However,” the story added, “76 agencies are pencil-pushing, regulatory agencies, i.e. Environment Protection Agency (EPA), Social Security Administration (SSA), Veterans Affairs (VA), Internal Revenue Service (IRS), Health and Human Services (HHS), Department of Transportation, U.S. Department of Agriculture (USDA) and many others.”

In a news release announcing her legislation, Ernst stated The Why Does the IRS Have Guns Act would:

Prohibit the IRS from buying, receiving, or storing guns and ammo,

Transfer all guns and ammo currently in the IRS’ possession to the General Services Administration,

Auction off these guns and ammo to Federal Firearms License owners and devote proceeds to deficit reduction, and

Relocate the IRS Criminal Investigation Division within the Justice Department.

The amount of money spent on guns and ammunition is alarming, but even more worrisome to Gottlieb is the amount of ammunition and firearms the agency has amassed.

“One has to wonder whether IRS agents are working for the taxpayers, or preparing to go to war against them,” he mused. “The worst thing people should ever face from the IRS is an audit, not a firing squad.”

If it passes into law, Ernst’s legislation will become effective 120 days after enactment, and require the IRS commissioner to transfer guns and ammunition already in IRS possession to the General Services Administration where it would be auctioned off to federally-licensed firearms dealers to help bring down the federal deficit.

“American taxpayers feel intimidated enough by the IRS without facing the prospect of armed agents coming to our doors,” he observed. “What is truly alarming is that this has been going on for years, at the cost of more than $35 million since 2006. However, over the past couple of years, it appears the Biden administration has literally weaponized the agency, and the American public should not be amused. Disarming the IRS will make us all feel safer, and we’re delighted Sen. Ernst is willing to do something about it.

“Unfortunately,” Gottlieb quipped, “contributions to the Citizens Committee to support this legislation are not tax deductible. On the plus side, this means making a donation won’t trigger an IRS audit.”