By Joseph P. Tartaro | Executive Editor

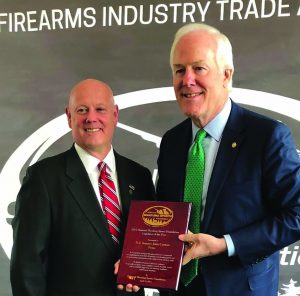

NSSF names Cornyn Legislator of the Year

National Shooting Sports Foundation’s (NSSF) Senior Vice President and General Counsel Larry Keane (left) stands with Senate Majority Whip John Cornyn (R-TX) after Cornyn received the firearm and ammunition trade association’s 2017 Legislator of the Year award for his sponsorship of S-2135, the Fix NICS Act, at the organization’s annual dinner in Washington, DC, in April.

While anti-gun activists have been dancing in the blood of the Parkland, FL, school shooting victims, the vultures have been circling overhead. Banks, unions and state governments, as well as Internet providers, have been busy trying to cut off the financial blood of the gun industry and firearms community.

Lets’ start with the banks that have been making headlines.

JP Morgan Chase and other large financial institutions have cut their exposure to the firearms industry, even as a top rival, Wells Fargo still appears to be sticking to its gunmakers business.

According to USA Today, JPMorgan Chase’s business relations with gunmakers “have come down significantly and are pretty limited,” Chief Financial Officer Marianne Lake told reporters after the nation’s number one bank by assets issued its first-quarter earnings results.

“We do have robust risk management practices and policies associated with this, and we have had (them) for a number of years,” said Lake. “We continue to always refine them and work on them.”

Separately, Wells Fargo’s top financial executive said the nation’s No. 3 by assets had no immediate plans to end its business dealings with gunmaker clients.

“This requires a legislative solution,” Chief Financial Officer John Shrewsberry said during a conference call with reporters after the San Francisco-based bank issued its own first-quarter earnings.

“We’re not currently setting policy in our extensions of credit,” added Shrewsberry.

These financial institutions were the latest major US banks to go public with any changes in gun industry business following outside pressure related to the Feb. 14 massacre that killed 17 people in Parkland, FL.

The February school shooting has spurred nationwide calls for stricter gun control, demands that have been opposed by the National Rifle Association and other organizations that oppose any weakening of the constitutionally protected right to bear arms.

Among them, pressure on Wells Fargo from the American Federation of Teachers (AFT).

Some media reports say that Wells Fargo has been the gun industry’s top financier, citing Bloomberg News as their source.

The bank has had a long business relationship with the National Rifle Association through other financial institutions taken over by Wells Fargo, the report said.

However, other US banks already have moved to cut or reduce ties with gun industry business clients in recent weeks.

Earlier, Bank of America said it would stop lending to business clients that manufacture military-style weapons for civilian use.

“We do have a few manufacturers of military-style firearms” as clients, Anne Finucane, the Charlotte, NC-based bank’s vice chairman, said during a Bloomberg TV interview. “We’re in discussions with them. We have let them know … it’s not our intention to underwrite or finance military-style weapons on a go-forward basis.”

Asked whether Bank of America would adopt a similar stance toward retailers that sell military-style weapons, Finucane told reporters such a decision would get into issues involving “civil liberties and the Second Amendment.”

“That’s a good public dialogue, but that’s a long way off,” said Finucane, whose bank is the nation’s second-largest by assets.

Citigroup announced new gun-related restrictions on its business partners, including retailers, in March, requiring them to bar firearm sales to customers under age 21, as well as those who have not passed a background check.

The New York-based bank said it is also barring clients from selling high-capacity ammunition magazines, as well as so-called bump stocks.

USA Today reported that Amalgamated Bank announced similar restrictions, saying it would not invest any of its own assets “in companies that manufacture or distribute firearms, weaponry or ammunition.”

The American Federation of Teachers (AFT), an affiliate of the AFL-CIO, that represents 1.7 million members in more than 3,000 local affiliates nationwide, first threatened to withdraw Wells Fargo mortgages from benefits program if bank continues to do business with NRA, gun manufacturers

The AFT president, Randi Weingarten, had attempted to meet and negotiate with Wells Fargo CEO Tim Sloan to discuss the bank’s ongoing support for the gun lobby and gun manufacturers,

“If Sloan continues the bank’s arms business, the AFT will dump its popular Wells Fargo mortgage program offered to members,” the teacher organization said.

The AFT also noted that while other leading companies—including Dick’s Sporting Goods, REI and L.L. Bean— have acted to protect kids and educators in the wake of the Parkland massacre, Wells Fargo continues to bankroll the NRA and help gun manufacturers such as American Outdoor Brands Corp. (the parent company of Smith & Wesson), and Vista Outdoor (parent of Savage Arms and Federal ammunition) borrow hundreds of millions of dollars.

Then on April 19, the AFT announced in a press release that it had pulled some 20,000 mortgages out of Wells Fargo and would urge other unions to take similar action.

Pressure on financial institutions to cut off financial aid to the firearms industry is not new. After the 2012 Sandy Hook school shooting in Connecticut public employee pension funds in California, New Jersey and New York put pressure on financial institutions to divest themselves of stock holdings to publicly traded gun manufacturers.

And the states have not backed down during the current campaign to cut off the public and private gun industry’s funding,

The New York Daily News reported from Albany that Gov. Andrew Cuomo’s administration is urging banks and insurance companies in New York to reconsider any ties they have to the gun industry.

Citing letters being sent as early as mid-April, the state’s top financial services regulator warns banks and insurers of the “reputational risk” they incur by doing business with the National Rifle Association and the gun industry.

The letter from Department of Financial Services Superintendent Maria Vullo does not threaten to impose any penalties on institutions that maintain ties with the gun industry, but notes the public outcry that followed the recent shooting rampage at a high school in Parkland, Fla.

Vullo noted that a number of businesses, including state-regulated MetLife, have already curtailed their relationships with the NRA in the wake of the Parkland mass murder.

Tom King, an NRA board member from New York and president of the state Rifle & Pistol Association, blasted Vullo’s letter as “extortion,” the Daily News reported.

And the Chicago Sun-Times reported that Mayor Rahm Emanuel’s plan to strip financial institutions whose clients allow unrestricted gun sales of their seats on the gravy train tied to city bond deals stalled amid opposition from the banking industry.

The City Council’s Finance Committee postponed a final vote at the behest of Ben Jackson, vice-president of government relations for the Illinois Bankers Association.

Under Emanuel’s plan, in order to remain eligible for city business, financial institutions’ clients would also need to ban the sale of firearms to customers under the age of 21 and those who fail to pass background checks.

Financial institutions that fail to adopt that so-called “Safe Guns Policy” would have been declared ineligible to do business of any kind with the city.