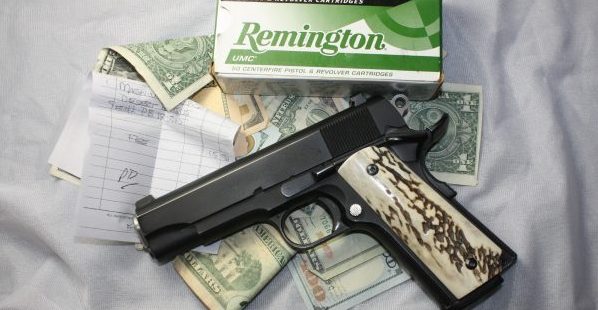

The Second Amendment Foundation has sued the City of Seattle, alleging a violation of the Public Records Act for not disclosing “gun tax” revenues the city collected during the first quarter of this year. (Dave Workman photo)

The Second Amendment Foundation (SAF) has sued the City of Seattle in King County (WA) Superior Court, alleging a violation of the state Public Records Act for refusing to disclose revenue data related to the city’s controversial “gun violence tax” that was adopted last year.

The complaint stems from a PRA request earlier this year by TGM Senior Editor Dave Workman, seeking information on the gun tax revenue for a follow-up report.

In April, TGM filed a public records request, seeking information about the first-quarter revenue from the gun tax. That tax is being challenged in court by SAF, the National Rifle Association and National Shooting Sports Foundation, along with two local retail gun shops. They contend that the gun tax is really a gun control effort disguised as a tax in order to skirt Washington State’s 33-year-old state preemption law.

“When Seattle hastily adopted this tax last year,” said SAF founder and Executive Vice President Alan M. Gottlieb, “then-Council President Tim Burgess sold it as a means of raking in between $300,000 and $500,000 annually by taxing the sale of firearms and ammunition. But now the city is refusing to turn over revenue information on the flimsy grounds that it may violate the privacy of retail gun dealers in the city.”

Gottlieb also serves as TGM publisher. The magazine covers a variety of firearms-related news ranging from politics to firearms and equipment reviews. It is based in Buffalo, N.Y. with a Western Bureau at SAF’s headquarters in Bellevue, a city located on the east shore of Lake Washington opposite from Seattle.

The gun violence tax was set up to charge $25 on the sale of each firearm, plus five cents per round of centerfire ammunition and two cents per round of rimfire ammunition. It is very similar to a tax created in Cook County, Illinois with similar goals: to provide funding for intervention and gun violence education efforts.

When the city refused to divulge its first-quarter gun tax revenue, citing individual taxpayer confidentiality concerns, Senior Editor Dave Workman modified his request “to accommodate the city’s concerns about taxpayer privacy,” according to a Thursday morning SAF news release.

Julie Moore, communications director for the city’s Department of Finance and Administrative Services, responded in a July 14 e-mail to Workman that she had been “communicating with reporters on this same topic.”

The Seattle Times had earlier reported that the Outdoor Emporium, one of the two retailers involved in the gun tax lawsuit, had “paid about $21,000 in first-quarter gun and ammo taxes according to owner Mike Coombs.

In that e-mail to Workman, Moore explained, “The City’s position is we will not release any information about taxes collected/reported for the firearms and ammunition tax at this time due to the limited amount of information received to date and legal requirements for protecting taxpayer confidentiality.”

She also asserted that “Taxpayer information is exempt from public inspection” under the state law.

Workman maintains that “the citizens of Seattle and every gun owner in the state deserve to know whether the city’s revenue prediction was even remotely accurate, or way off base.”

“The city simply cannot be allowed to adopt a tax on the exercise of a constitutional right and then stonewall the public and the press about that,” Gottlieb said.

The initial gun tax lawsuit was rejected in King County Superior Court, but SAF, NRA and NSSF appealed. Arguments in that case were originally scheduled later this month in Division I of the State Court of Appeals, but were moved back to November.

SAF is represented by Seattle attorneys Steven Fogg and David Edwards with Corr, Cronin, Michelson, Baumgardner, Fogg & Moore. Fogg and Edwards also represent SAF, NRA and NSSF in their challenge of the Seattle gun tax.